We always heard about this: Why do I have to share the property with aunties / uncles where I bought it together with my other half and still need their permission when I put it on sale?

Let’s take a look here, a couple saved up and bought a joint name property. And when the other half passes away without writing a will, what would happened?

Wife was entitled for 1/2, the other 1/2 were entitled by the parents. If the parents has no will too, then joint name account will be facing freezing and unfreezing breach.

If the husband’s parents were deceased too, then it would be wife 1/2 and four issues 1/2 equally.Screen reader support enabled. Now, five persons are entitled! And everyone needed to agree for transfer of ownership.If one of it were at overseas or issue doesn’t agree to, then procedure would be very complicated. This is an example of being intestate, it might be unfair to some of you but unfortunately this scenario cannot be reversed No matter how it can be troublesome, this property is entitled to 5 persons by law.

In Short:

Joint Name Property: The 50% owned by the husband will be distributed 1/2 to the spouse and 1/2 to the husband’s parents.

Single Name Property:

The 100% owned by the husband will distributed equally to spouse 1/2 and 1/2 to the husband’s parents.

Writing a will and Set Up Legacy:

Spouse can fully control on the property, while setting up a legacy as pension fund to parents. It only need just one signature if selling off, then insurance fund would work as pension fund for parents.

By writing a will, when one had passed on and under the act of law, everything will be allocated accordingly by the deceased.

Thanks for reading

Who's My Executor

Normally, executor of an estate is one of the beneficiaries(wife for an example) and she will have greater responsibility compare to others.

Normally, executor of an estate is one of the beneficiaries(wife for an example) and she will have greater responsibility compare to others.

Things that an executor have to do:

Find out where's the will, and look for a lawyer

Apply for legacy certificate from the court

Gather all the assets

Pay all the debts

Allocate the assets accordingly to the will

Prepare statement of accounts

If there's any mishap happened on what has mentioned above, then the executor will have to bear the responsibility by the law. Therefore, an executor must have requirements below:

- Conveniently to attend court at anytime, healthy

- No conflict of interest with beneficiaries

- No conflict of interest with your own

- Fluent in English and Bahasa Malaysia

- Have plenty of time to run around different departments

- Staying at same area, not overseas, and has transport

With the appointment of Rockwills executor, you will be free from these troubles and loopholes. So your beneficiary will be at ease.

Thanks for reading

When Should I Consider Getting a Will?

When we are facing different life stages regarded below, then probably it's the time for us to be caution by writing a will or rewriting the will.

- marriage

- newborn

- charitable donation

- divorce / relationship breakdown

- travelling

- acquire new assets

- coversion to Islam

Important notes : Due to the conflict on interest, never let the beneficiary to become witness or the will would become invalid instantly.

Thanks for reading

mySafebox- Will Custody

Do not keep any will inside the bank safe deposit box! Cause once the bank account frozen when someone passed away, it will not able to be taken out.

If will were not able to be handed out or kept it hiddenly so as couldn't be find by the family, it would taken as intestate too.

Other than the problem of allocation without a will, many of us would face the awkward situation that who should be the assets administrator and applying the Letter of Administrator is needed if intestate happens. This process will be complicated.

Firstly, who gonna be the administrator? An administrator will have full right on the estate. This might causing the family to have tough decision and probably would not able to hand out the right.

Secondly, who will be the guarantor? The administrator will have to appoint two guarantors with both of them at the same status to get the Letter of Administration, unless exemption is given by the court.

And thirdly, time consuming too

Lifetime will custody costs : RM 1,188 (Included a RM25,000 accidental death benefit, and enjoy a rewriting discount). you're able to lower the cost with an enjoyment of allowance too (Lawyer fee that cost RM6,000, just appoint "Rockwills" as your executor then there's no more administrator problem)

Thanks for reading

Will Rewriting

When it’s the time to rewrite the will, talk to your consultant for better review, suggestions, or enjoy more discount with more benefits.

Discount:

Enjoy 20% off for the total terms of 30 and below

Enjoy 50% off for the total terms of 30 and above

Let’s take a look at some example of special cases listed below that crucially needed for will rewriting.

1. When you get married or remarried.

2. If you or the beneficiary had changes name.

3. If your executor passes away or not able to represent you for legacy allocation.

4. If any changes that would affect your will.

Before we left this world, we are able to change the content of will at anytime. The previous old will would become invalid and replaced by the new written will.

Will Translating

If the will were written in English, the process in the court would be expedite. However, will translation is available too

Translation Fees:

60% of final will cost

Thanks for reading

What If Deceased Without Will?

Before the estate to be passed to the inheritor, debts have to be repay first to the organisation and creditor, which is complicated process and time consuming

What to do if the deceased got no will here in Malaysia?

Without will, dispute might happened between the family members due to some "benefits". And some worrying process regarding lawyers, executor or administrator that causes estate to be left hanging.

We can appoint Rockwills Trustee Bhd to surpervise their estate. Of course that entrusting a trust company would involve some charges, but this could lighten the complicated process and it's better than relying on human for personal "benefits".

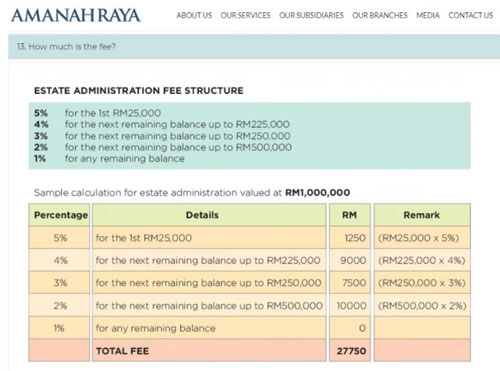

Table below shows《Rockwills Estate Administration Fees》

Thanks for reading

Hot Selling Packages

Researching what had others done with their past experiece, now you can even save more with the right packages provided.

According to a survey, about 90% of people in Malaysia have not made a will. Failure to follow the application process and failing to follow up and take back the property voluntarily led to a legacy worth up to RM60 billion, which was unclaimed and frozen by several government agencies that manage deposits and assets.

What's the Hot Selling Packages?

You ca start from here:

- Executor at least 2 person

- Guardian at least 2 person

- 6 beneficiary person or more

- Cover all assets including future unearned assets

You only pay for what you need

Will Writing:RM480

One Trust:RM388

Lifetime will custody costs : RM 1,188 (Included a RM25,000 accidental death benefit, and enjoy a rewriting discount). you’re able to lower the cost with an enjoyment of allowance too (Lawyer fee that cost RM6,000, just appoint “Rockwills” as your executor then there’s no more administrator problem) appoint Rockwills Executor:RM 120 (you can even enjoy free of charge on special pre-paid promotion occationally) Exclusive Estate Administration Uprepare Service:RM1,200 (customised for multiple estate administration services from an exclusive discount price)

Thanks for reading

Rockwills Trust

Family trust plan is the best way to hand down the legacy, it able to distribute and arrange everything gradually, stage by stage.